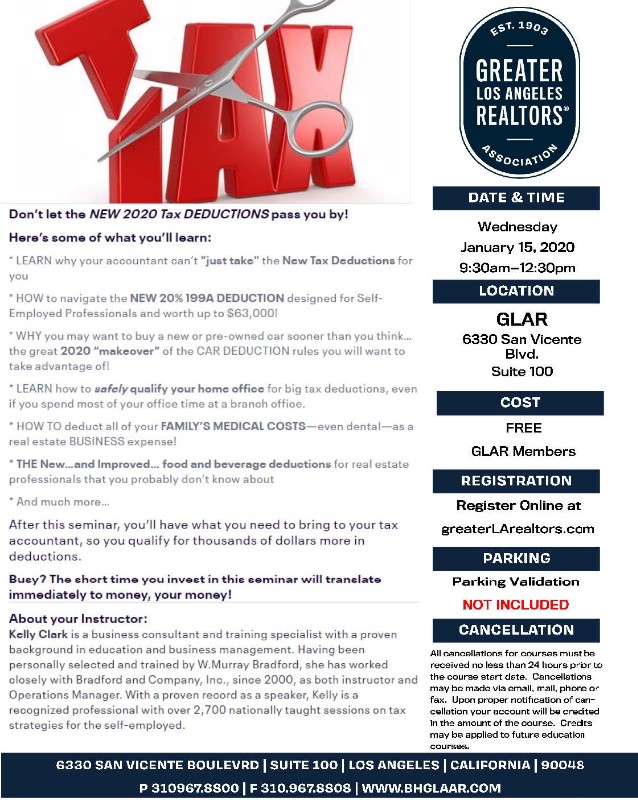

Don’t let the NEW 2020 Tax DEDUCTIONS pass you by!

Here’s some of what you’ll learn:

* LEARN why your accountant can’t "just take" the New Tax Deductions for you

* HOW to navigate the NEW 20% 199A DEDUCTION designed for Self-Employed Professionals and worth up to $63,000!

* WHY you may want to buy a new or pre-owned car sooner than you think…the great 2020 “makeover” of the CAR DEDUCTION rules you will want to take advantage of!

* LEARN how to safely qualify your home office for big tax deductions, even if you spend most of your office time at a branch office.

* HOW TO deduct all of your FAMILY’S MEDICAL COSTS—even dental—as a real estate BUSINESS expense!

* THE New…and Improved… food and beverage deductions for real estate professionals that you probably don’t know about

* And much more…

After this seminar, you’ll have what you need to bring to your tax accountant, so you qualify for thousands of dollars more in deductions.

Busy? The short time you invest in this seminar will translate immediately to money, your money!

About your Instructor:

Kelly Clark is a business consultant and training specialist with a proven background in education and business management. Having been personally selected and trained by W.Murray Bradford, she has worked closely with Bradford and Company, Inc., since 2000, as both instructor and Operations Manager. With a proven record as a speaker, Kelly is a recognized professional with over 2,700 nationally taught sessions on tax strategies for the self-employed.